In this article, we will look at the features of altcoin trading during their pumping. In our opinion, the most interesting pumping occurred in the period from September to December 2022 with MASK and LEVER coins.

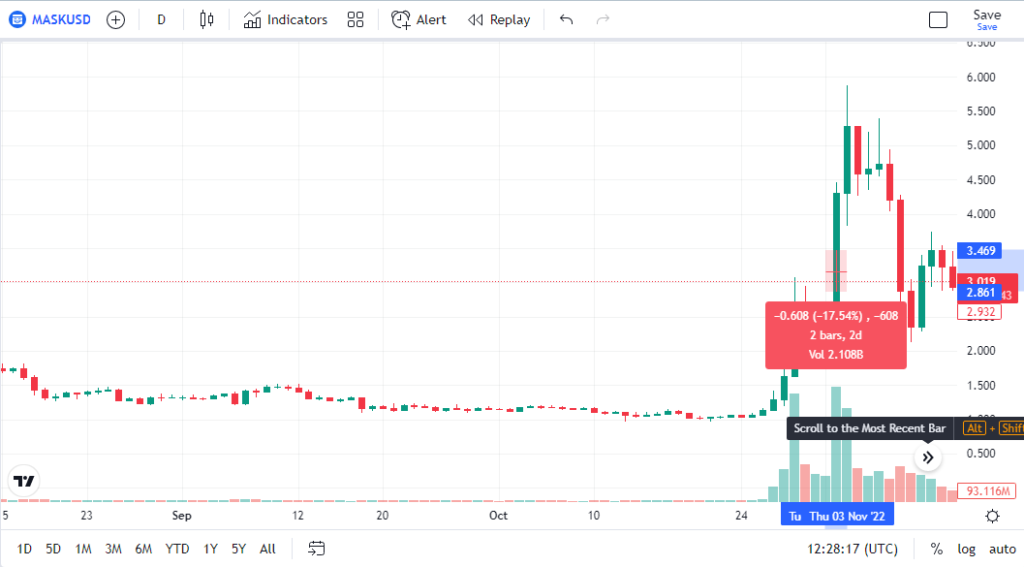

Fig.1. MASK pumping – 480% in 9 days!

In general, pumping is a business project consisting in a long–term recruitment of a huge position during a strong subsidence of coins at the bottom and further sale of the positions gained after performing sharp price outliers and involving a huge number of participants-traders in the process. Sales are carried out in batches at the tops of price spurts, when more and more people who want to get rich on price growth impulses enter the market. As a result of pumping, you can earn just a lot of money. So before the start of pumping, Mask had daily volumes of about $ 300,000, at the peak of pumping, the volumes reached $ 100,000,000, which allowed pumping to be performed several times (see Figure 1). Pumping is always a long–awaited event in the market, because you can suddenly get rich or lose the entire account.

So, let’s consider a safe trading strategy during pumping. Let’s say you have an account of about $ 100.

Fig.2. You found a sharp price jump of 55%.

So, MASK has been falling hopelessly since April 2022, no hopes for growth. However, on 28.10.22, quite unexpectedly, the price jumped by 56%, you immediately enter the short – a huge success, you think, an absolutely hopeless coin was tossed, then it will be drained at any moment in order to have time to get rich. Of course, you enter 3x or more, hoping that in the worst case, the price may still jerk by 30%, which will not exceed your existing account of $ 100. Great idea, isn’t it? Wealth is just around the corner.

But already on 29.10.22, the unexpected happens – the price soars at a peak of 186% from the start of trading and your account is immediately liquidated. However, we are not so simple, we go to 5x from $ 100 again, hoping that all the growth is over, we give a 20% margin for our 100%.

Fig.3. The continuation of the pumping is already 186% from the beginning of the pumping.

Fig.4. Obvious braking of pumping 30.10-01.11.22.

The next 3 days we nervously watch how the price almost does not knock us out again, but then it seems to calm down, and we add more money to the position, for example, we sell for another $ 300. Ie, the shorts are already at $ 800!! To ensure margin, we add another $ 200 to the account – a total of $ 300 on the account, i.e. we can again sit out a 30% price jump.

Fig.5. Pumping is alive – 320%. 02.11.22 our account is being liquidated again, i.e. we have already lost $ 100 + $300 = $ 400 from the beginning of pumping. We need to recoup, 320% is too much. We throw $ 300 into the account and shorten it by $ 1000 – a Porsche or a walrus!

Fig.6. 03.11.22 – pumping is alive – 452%!

03.12.22 we get the liquidation of the account again. The loss of $700 is no more money. We borrow $100 from a friend to take a chance again. We put it in the short again, but only by $ 100.

Fig.7. Signal about the end of pumping.

04.11.2022 we get a long-awaited profit of $ 20!. Hurray!. Of course, we add shorts up to $ 200, we pray.

Fig.8. 06.11.22 shooting is observed no more than 17% up.

17% of the shots give a drawdown for a $ 200 position of the order of -34$. The $100 we have is intact.

Fig.9. 07.11.22 another long-awaited candle down.

07.11.22 after the experience, seeing a 20% reduction in the price and a profit of $ 40, we exit the transaction, give a friend $ 100. We have $40 profit and $ 700 loss, we decide to enter the short on the next price surge up.

Fig.10. 08-09.11.2022 the price is falling rapidly, without giving you time to come to your senses.

However, 08-09.11.2022 the price does not rise, but falls sharply down, we miss the last chance. But the desire to recoup does not give rest, we are waiting for the price to go up.

Fig.11. The price spurt up by 59%.

10.11.22 we see a huge price jump by 59% up. But you can’t fool us. We are waiting further to short for sure. This is our clear win-win plan.

Fig.12. A small break up by 15%.

11.11.2022 we observe a relatively weak upward jerk by 15%, we decide to short by $ 100, having $ 40 in the account.

Fig.13. Downward movement by 17%.

12-13.11.22 we get $17 profit.

The total result: earned $ 57, lost $ 700. This is how the creators of pumping earn your money by snatching it out of your hands.

Let’s consider the mistakes that led to such sad consequences.

1) The results of pumping are unknown in advance. There are cases of pumping movement from 15-7000%, which should be taken into account when trading, setting the size of your account.

2) When working with pumping, it is advisable to divide the account into at least 10 parts, adding each part after receiving signals to add. In the case discussed above, the signal was long daily red candles.

3) It is advisable to set the upper limit of your participation in the pumping with a stop loss, at the level of 100%, above the current transaction price.

4) During the pumping, you will be torn apart by sharp desires and regrets about the lost profits, but you should strictly limit yourself and set the parameters of the limits of participation in the pumping in advance so as not to lose your account.

Let’s consider how it would be possible to participate in pumping with a $100 account (see Table 1).

Table 1. A possible strategy for participating in pumping.

| Balance, $ | 100 | ||||

| Money in the transaction,$ | Current % of pumping, % | Current account, $ | Current loss, $ | Situation | Action |

| 10 | 56 | 100 | 0 | Fig.2 | |

| 20 | 186 | 87 | 13 | Fig.2 | Adding to the short 10$ |

| 20 | 320 | 60,2 | 26,8 | Fig.5 | |

| 30 | 452 | 33,8 | 26,4 | Fig.6 | Adding to the short 10$ |

| 40 | 326 | 71,6 | -37,8 | Fig.7 | Adding to the short 10$ |

| 40 | 120 | 154 | -82,4 | Fig.10 | Exit from the transaction |

In total, according to the primary strategy, the gain is $ 57, the loss is $ 700.

According to the strategy according to Table 1: $54 win, $0 loss.

It seems to us that the second option is more preferable.

In our book “Trading. Recipe Book” we promote the long money strategy when working with altcoins. An example of such a strategy is given in Table 1. Its essence is that we divide the available capital into at least 10 parts. Since the minimum transaction size on BINANCE is usually at least $ 10, we get a minimum account size of $ 100. This account allows you to sit out the pumping at 500%. Let’s consider another illustrative example of a good pumping, which at the time of writing the article has not yet been completed. This is a LEVER coin pumping, see Fig. 14.

Fig.14. LEVER coin pumping – 423% in 26 days.

The LEVER coin has been in decline since mid-July after a strong pumping of 311%. On 11/22/2022, the price was pushed up by 93%, which was the reason for our entry into the short according to Table 2.

Fig.15. The beginning of the LEVER coin pumping.

Fig.16. Continuation of the pumping 27.11.22

Fig.17. Continuation of the pumping of the LEVER coin on 11.12.22

Fig.18. The state of pumping at the 13.11.22.

Fig.19. The state of pumping at the time of writing the article.

Рис.20. The goal of extracting profit from the pumping of LEVER coins.

Таблица 2. Стратегия короткой прокачки монет с использованием рычагов.

| Balance, $ | 100 | ||||

| Money in the transaction,$ | Current % of pumping, % | Current account, $ | Current loss, $ | Situation | Action |

| 10 | 60 | 100 | 0 | Рис.14 | |

| 20 | 150 | 87 | 9 | Рис.15 | Adding to the short 10$ |

| 20 | 288 | 59,4 | 27,6 | Рис.16 | |

| 30 | 369 | 43,2 | 16,2 | Рис.17 | Adding to the short 10$ |

| 40 | 262 | 75,3 | -32,1 | Рис.18 | Adding to the short 10$ |

| 50 | 25 | 170,1 | -94,8 | Рис.19 | An imaginary profit target 70$ |

According to Table 2, we see that the pumping is not completed, but you, dear reader, can offer your strategy and try it in practice. We assume that the expected profit will be $70 for an account of $100. Not bad, huh?

We wish you success with our trading technologies.